ZAMBEEF Forecasts Better Than Expected Revenue at FY 2022

Fully integrated cold chain foods and retail business ZAMBEEF has announced it expects better than market forecast revenue, according to a statement from the Company.

“The Group announces that for the full year ending 30 September 2022, revenue (reported in USD) is expected to be 10% above current market expectations, with EBITDA, EBIT and adjusted Profit Before Tax* being 15% – 25% ahead of current market expectations”, read a statement issued by AUTUS Securities Limited on behalf of the company on 27th April 2022.

According to the statement, “the half year period ended 31 March 2022 saw macroeconomic fundamentals stabilise”. These included the exchange rate remaining relatively stable and inflation steadily reducing.

However, “the delayed payment of non-interest bearing government domestic arrears and a tight monetary policy resulted in constrained consumer spending, thereby impacting the Retail and Cold Chain Food business”.

The company remains optimistic going forward. “Despite these headwinds, the Group is expected to post results ahead of market expectations, driven by a strong focus on cost control and favourable commodity pricing, particularly from higher soya bean prices from which the Cropping division is benefitting from”.

The company has further revamped its strategy on increasing sales through an inward looking approach. “In addition, a renewed focus in the financial year on price moderation, innovation, channel development and a sales execution strategy is expected to stimulate volume performance and, therefore, profitability during the second half of the financial year”. Management is bullish on its strategy and expects it yield positive results. “Full year financial performance is also expected to benefit from the diversified portfolio of businesses in which we operate”.

The company is cognizant of the impact global affairs and their impact on the business. “Notwithstanding our expectations, the Russia – Ukraine conflict and its impact on input raw material costs remain of concern”.

Debt, which has been a huge concern of the Board and Management team continues to steadily reduce. “The Group’s net debt** position as at 31 March 2022 was circa USD33million (31 March 2021: USD45million, 30 September 2021: USD42.7million)”.

“The Group expects its results for the six-month period ended 31 March 2022 to be released by the end of June 2022. Shareholders are advised that the information contained in this Trading Statement has not been reviewed nor reported on by the external auditors”.

DRC and Angola on the verge of settling a 50-year dispute over an offshore Block

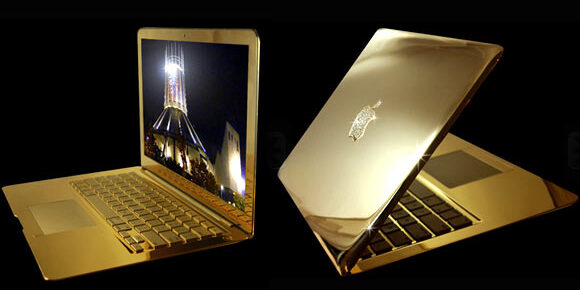

DRC and Angola on the verge of settling a 50-year dispute over an offshore Block  TENDER FOR THE SUPPLY AND DELIVERY LAPTOPS | ZAMBIA

TENDER FOR THE SUPPLY AND DELIVERY LAPTOPS | ZAMBIA  TENDER FOR THE ESTABLISHMENT OF A FRAME AGREEMENT FOR RENTAL OF LIGHT VEHICLES | SUDAN

TENDER FOR THE ESTABLISHMENT OF A FRAME AGREEMENT FOR RENTAL OF LIGHT VEHICLES | SUDAN  Zimbabwe Celebrates NEW $200 million Parliament Building Gifted by China

Zimbabwe Celebrates NEW $200 million Parliament Building Gifted by China  infrastructure, the Busanga dam built by SICOMINES finally operational

infrastructure, the Busanga dam built by SICOMINES finally operational  TENDER FOR THE ESTABLISHMENT OF CODING & ROBOTIC HUBS IN SCHOOLS | SOUTH AFRICA

TENDER FOR THE ESTABLISHMENT OF CODING & ROBOTIC HUBS IN SCHOOLS | SOUTH AFRICA  President Akufo-Addo Inaugurates Dualisation of Anwiankwanta-Ahenema Kokoben Road to Ease Traffic and Boost Connectivity

President Akufo-Addo Inaugurates Dualisation of Anwiankwanta-Ahenema Kokoben Road to Ease Traffic and Boost Connectivity  Angola-Zambia Road Project to Boost Trade and Economy in Eastern Angola

Angola-Zambia Road Project to Boost Trade and Economy in Eastern Angola  Power China Group Utilizes Linnhoff TSD1500 for Key Rural Road Projects in Kenya

Power China Group Utilizes Linnhoff TSD1500 for Key Rural Road Projects in Kenya